Bee Chun Boo

Partner in Baker McKenzie’s Mergers and Acquisitions group

Ben Simpfendorfer

Founder and CEO of Silk Road Associates

As ripple effects from the coronavirus are felt across the globe, the nature, pace and scope of Belt and Road Initiative (BRI) activity will also be affected, both in the near and longer-term future. As China mobilizes resources to manage containment of the virus, it also has to balance challenges to Chinese liquidity and the general economic downturn.

COVID-19 will alter the flow of BRI activity in three key areas: global supply and digital value chains, the rise of private sector involvement and increased opportunities for international collaboration.

However, despite the challenges to manufacturing and supply chain activity, the pace of digital BRI activity has ramped up, as has investor interest in Chinese tech companies and the general health care industry.

Fundamental Change in Global Supply Chains

Since 2018, Chinese companies have refocused their efforts on the larger markets of Southeast Asia, where supply chain linkages with China are strong and investment returns are more predictable. COVID-19 will only supercharge the ongoing momentum of Chinese private manufacturers investing in Southeast Asia or cause them to consider their options.

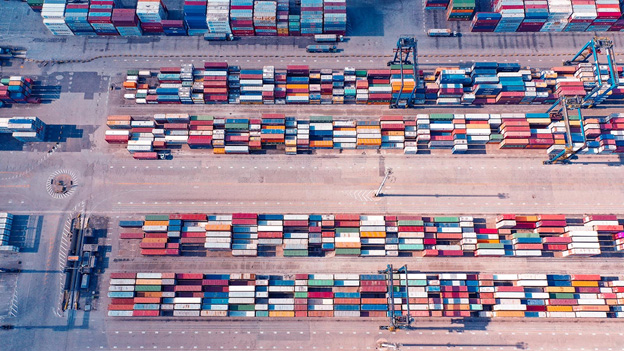

As a growing number of Chinese manufacturers, alongside their mainly North Asian partners, seek to build capacity across Southeast Asia and hedge against the rising risks of supply chain disruption, Chinese infrastructure investments in Southeast Asia will benefit from these flows.

Additionally, Chinese state companies have already turned their focus to investments in ports, power and industrial parks across Southeast Asia, especially where these projects are aligned with Chinese investment in manufacturing and support the development of Chinese commercial ecosystems within the region.

Expedited Digital BRI

There are opportunities aplenty for a full digital value chain for BRI activity, from ICT companies to e-commerce platforms, including firms that are well-established throughout the BRI geography, such as Huawei, Alibaba and Tencent.

It will be a natural fit for Chinese tech companies such as Alibaba’s DingTalk, Tencent’s WeChat Work and Huawei’s WeLink to bid for market share outside of China, especially in the BRI region. China’s medtech sector may similarly find opportunities abroad. In the past few months, online doctor consultation platforms (Alibaba Health, Ping An Good Doctor) have seen consultations soar. Similar technologies may be able to be successfully implemented abroad if staffed by locals, given health sector shortfalls in many BRI countries.

“Whatever the lasting impact of COVID-19 on the global economy, Belt and Road Initiative will remain a priority for China.”

China’s success in using AI and other technologies to identify and monitor virus carriers may also have application across the BRI, especially in those countries, such as India and Thailand, which are currently developing smart cities and where China’s technology companies are already heavily committed.

Rise of Private Sector Involvement

Chinese state banks will face greater capital constraints over the coming 12 months, and non-performing loans are likely to rise at home, owing to COVID-19-related financial weakness even as investments into the domestic health sector or other related infrastructure increase.

If Chinese state banks reduce funding, then Chinese private financial sectors will need to fight against weakening domestic conditions to play an even greater role. The private sector will likely focus on the most commercially profitable supply chain-related investments, especially those related to industrial or mixed-use commercial projects that benefit from the relocation of production away from China to other low-cost destinations, as well as sales to the domestic market and BRI countries.

Great Opportunities for International Collaboration

The U.S.-China trade war and COVID-19 only further incentivize China to adopt a more collaborative model toward BRI. BRI projects will increasingly focus on profitable supply chain-related opportunities in Southeast Asia, where the private sector and private capital play a greater role.

Even as COVID-19 spotlights the importance of supply chain diversification, the virus may similarly nudge BRI governments to consider the downfalls of their overdependence on a single country, especially should travel restrictions become a routine exercise each winter.

The Outlook

Whatever the lasting impact of COVID-19 on the global economy, BRI will remain a priority for China. What remains important will be the government’s short-term and long-term response to the virus, shortfalls in China’s health sector and the economic fallout for the country’s financially challenged small and medium-sized enterprise sector. This will likely divert official attention and resources away from BRI over the next 12 months — and potentially longer.

The reduced flow of Chinese capital and the economic fallout for the country’s financially challenged SME sector may bring about a less enthusiastic attitude toward the BRI over the next 12 to 24 months as China’s priorities shift to delivering results at home rather than abroad. This may mean reduced investments into BRI’s smaller, less critical markets where there are limited opportunities to connect such investments to the global supply. Central Asia, sub-Saharan Africa and Eastern Europe will accordingly see a short-term dip in BRI-related activity, relative to Southeast Asia.

Despite this, the outlook is far from bleak. As China seeks to share its valuable experience of battling COVID-19 with other BRI countries, one key area of potential will be in projects focused on strengthening the health systems of low-income countries, even if focused on soft processes rather than hard infrastructure. This would be a potential area where China is likely to publicize its efforts as being a part of the BRI.

Beyond the short-term, changes to global supply chains will bring new opportunities for diversification through joint activity with others in both North and Southeast Asia. There is also potential for accelerated digital BRI activity in relation to Chinese tech companies, and private players may now become more active in BRI. The quality of BRI activity should continue to improve in the longer term, owing to greater participation of the private sector and foreign companies, as well as BRI’s tighter alignment with global supply chains.

A version of this article originally appeared in the World Economic Forum’s Agenda blog.

This article retrieved from: https://www.brinknews.com/coronavirus-brings-the-opportunity-to-digitize-chinas-belt-and-road-initiative-bri-covid-19/, 4:01 PM Jakarta Time.