Financial inclusion is critical to improve the quality of life in ASEAN countries, particularly Indonesia. However, a financial inclusion gap exists between urban and rural areas. On the other side, digital finance has the potential to help eliminate inequality.

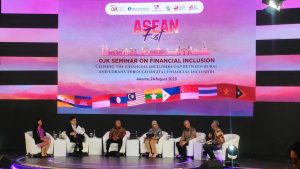

The OJK intends to hold the “OJK Seminar on Financial Inclusion: Closing the Financial Inclusion Gap Between Rural and Urban Through Digital Financial Inclusion” on Thursday, August 24, 2023, in order to meet the 2024 target of achieving 90% financial inclusion and narrowing the financial divide across Indonesia. This seminar is envisioned as a platform for public and private sector stakeholders to share experiences, comprehend challenges, and design solutions to improve financial literacy and inclusion in ASEAN countries. Furthermore, this programme is consistent with OJK’s support for Indonesia’s role as ASEAN Chair in 2023, with the overriding goal of supporting economic growth and stability in the ASEAN region.

The seminar focuses on rural communities in the ASEAN area, with the goal of closing the financial inclusion gap through digital financial inclusion initiatives. The presenter highlights ASEAN nations’ progress in reducing financial exclusion and emphasises the importance of empowering rural communities. They also discuss the importance of promoting economic growth in ASEAN and including remote regions into the financial framework. The speaker emphasises the importance of introducing digital financial services as well as calling for improved financial education. The session begins with a panel discussion centred on increasing financial inclusion in rural environments and highlights financial inclusion efforts occurring in Indonesia. Cooperation between government agencies, central banks, and financial institutions is critical for advancing financial education and inclusion.

During this seminar, a range of efforts and undertakings concerning the advancement of financial inclusion in ASEAN nations, notably in Indonesia, the Philippines, and Kuala Lumpur, are deliberated. The presenters emphasise the importance of collaboration among city governments, financial service providers, regulatory authorities, and other relevant parties. This collaboration aims to address capacity difficulties and challenges faced by local governments, as well as to improve financial understanding and foster inclusivity. The objectives include transforming social assistance beneficiaries into micro-entrepreneurs, building digital infrastructure to improve access to financial services, and providing financial help to marginalised and underprivileged groups. The seminar emphasises the importance of connectivity, inclusiveness, and financial education in achieving financial inclusion across the area.

Sarjito, Deputy Commissioner for Financial Services Market Conduct and Consumer Protection Supervision at OJK, discusses the Regional Financial Access team, a consortium of local government representatives, experts, financial service providers, and regulators, in Indonesia. The team aims to address challenges, foster financial awareness, and promote inclusivity. They focus on rural land certification and preventing predatory lending practices. The team emphasizes cooperative efforts and strategic alignment with MSMEs for better financing prospects. Financial inclusion is crucial in Indonesia, with financing needed in sectors like agriculture, education, livestock, and advisory services. The collaboration between regional financial access teams and service providers is crucial, as is the promotion of digitalization. The speaker acknowledges the financial inclusion gap and emphasizes economic empowerment as a foundation for financial inclusion.

Yunita Resmi Sari, Bank Indonesia’s Protection Department discusses a project promoting financial inclusion in Indonesia. The project transforms social aid beneficiaries into micro-entrepreneurs, with facilitators including local universities and NGOs assessing their economic potential. The project has been successful, with 91 projects across Indonesia, mainly involving women. Beneficiaries have started businesses, sold products through e-commerce platforms, and experienced increased income. Financial inclusion has improved, with 88% of members having financial records and 82% having savings accounts. The project emphasizes the importance of collaborative actions among stakeholders, including government, NGOs, universities, industries, and financial institutions, to empower people and create new entrepreneurs. The goal is to replicate these efforts and create microentrepreneurs across Indonesia, aiming for 90% economic and financial inclusion by 2024.

Dakila Carlo E. Cua, Governor of Quirino Province discusses financial inclusion in the Philippines, highlighting the necessity of accessible financial services for everyone, especially vulnerable groups. He references the country’s strategy for financial inclusion, involving local governments implementing plans and digital avenues to reach more citizens. The Philippines employs digital infrastructure to enhance financial inclusion, exemplified by the Paleng QR program utilizing QR codes in markets and transportation for financial access. Fintech companies are aiding the underserved, yet rural areas’ limited connectivity poses a challenge to digital service adoption. To address this, the speaker advocates for government investment in infrastructure to bridge the digital gap, ensuring universal financial inclusion. In essence, a connection exists between digital infrastructure and financial inclusion, necessitating simultaneous efforts in both areas.

Dato’ Mahadi Che Ngah, the 13th Mayor of Kuala Lumpur, emphasizes the importance of financial inclusion in achieving equity, inclusivity, and sustainability. He emphasizes the need to expand financial services accessibility and foster an inclusive urban environment for marginalized groups, such as the B40 category (earning less than $1,000 per month) and homeless individuals. To combat financial barriers, targeted interventions have been implemented, such as homeownership and small business establishment. The Kuala Lumpur City Hall actively oversees these initiatives, and an urban farming program has been introduced for homeless individuals. He also highlighted initiatives aimed at increasing financial inclusion, such as the establishment of the SDG Digital Centre in Kuala Lumpur, which monitors various programmes and financial inclusion implementation. This centre serves as a hub for information dissemination and simple access to resources.

Dr. Bernadia Irawati Tjandradewi, Secretary-General of UCLG ASPAC, presents an overview of finance options available to local governments for advancing financial inclusion. The speaker introduces programs that link local governments with potential donors and financial institutions. A member help desk has been established, and best practices are compiled, spotlighting initiatives like the Indonesian bank’s effort and the carbon bank system in Cambodia and Korea. Emphasis is placed on the significance of inclusivity and connectivity in financial systems, illustrated by examples such as digital platforms connecting urban farmers in Yogyakarta. The importance of women’s participation in development is highlighted, along with a recommendation for forming task forces for financial inclusion across ASEAN states. The significance of financial literacy for local governments in ASEAN countries is also discussed. Dr. Bernadia underscores the need to advocate for public-private partnerships and enabling policies that bolster financial options like PPP and municipal bonds. A noted concern is the limited issuance of municipal bonds in Indonesia, raising questions about the success of this funding mechanism in other nations like China and Japan for infrastructure projects. She underscores the value of research, data collection, and collaborative innovation labs in advancing financial inclusion efforts.

To summarise, the speaker highlights the challenges in providing financial services in rural areas, such as the lack of economic activity, high risk, and inadequate infrastructure. They propose investing in digital infrastructure to enable formal institutions’ access to these places more affordable. However, a predicament arises where both businesses and banks are reluctant to invest first due to the absence of activity or users. In response, they advise that governments limit this risk through public-private partnerships, with the government responsible for infrastructure investments and the private sector responsible for service delivery. The significance of teamwork, sincerity, and earnestness in achieving universal financial inclusion and economic empowerment is emphasised.

Other panelists echoed the emphasis on collaboration, high-quality financial inclusion, developing global solutions to local challenges, closing gaps, and imparting financial education. They see this as an opportunity for ASEAN countries to come together, bridging disparities by capitalizing on their shared cultural background and connectivity.