TO address the challenge faced by local governments in Indonesia in the management and prioritisation of local budget during pandemic, UCLG ASPAC and APEKSI’s collaborative programme, LOCALISE SDGs has engaged the Indonesian Regional Autonomy Monitoring Committee (KPPOD) and produced research and policy recommendations for insights to local leaders. This research was conducted with the support from the European Union (EU).

Challenges – Indonesian Context

The initial challenge is the pandemic management design that applies a combination of a collaborative-governance model with the principles of desentralisasi (decentralisation), dekonsentrasi (delegation of assignment from central government to governor), and tugas pembantuan (delegation of assignment to government one level down: central government to a province, province to city/district). At the same time, local governments have had to reschedule their programmes and utilise their budget during the period of deficit for local budgetary (first quarter of the fiscal year).

All of these issues hampered the national economic recovery programme. Fiscal pressure on the revenue side has stalled investment spending and the carrying out of infrastructure projects. With the bureaucratic machine not operating in full force, the Local Government’s Budget (Anggaran Pendapatan dan Belanja Daerah/APBD) cannot function optimally. This situation has resulted in the balance sheets of many regions stranded in the negative zone, with some going through a recession.

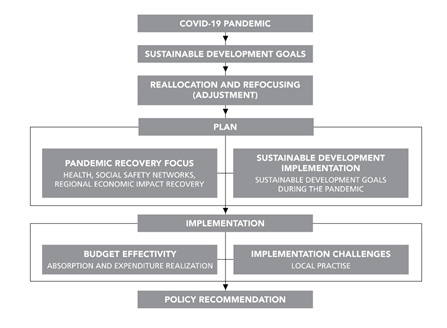

LOCALISE SDGs Research Framework

The framework of the research (Figure 1) focuses on the challenges of budget reallocation and refocusing in times of the COVID-19 pandemic and with the target of achieving the SDGs. From those problems, a recovery focus and development implementation are planned. To implement it, methods of alternative financing which are suitable for Local Authorities are proposed. Furthermore, despite written based on the Indonesian context, this research can also contribute to the body of knowledge in the Asia-Pacific region regarding the topic of alternative financing in general.

Financing the pandemic response while attaining the Sustainable Development Goals (SDGs)

In Indonesia, there are three focuses of government’s programmes to respond to the pandemic; those are (1) healthcare service programmes; (2) the social safety nets programme; and, (3) adjustments in programmes that also cover countermeasures against economic impacts. Such adjustments are fundamentally consistent with the agenda of SDGs and reflected in goals such as: (1) No poverty, (2) Zero hunger, and (3) Good health and well-being, as well as economic-related goals such as (8) Decent employment and economic growth and (10) Reduced inequalities. To support these goals, the Indonesian government has been implementing four central themes for the Local Government Work Plan (Rencana Kerja Pemerintah Daerah/RKPD) of 2021: the recovery of the industry, tourism, and investment sectors; healthcare system reform; social protection system reform; and disaster resilience system reform.

Alternative Financing during The Pandemic

As previously indicated, one of the most pressing issues during the pandemic is the decline of local revenue. In turn, this also contributes to the decline of Non-Tax State Revenue. Therefore, local governments cannot solely rely on, for example, Corporate Social Responsibility (CSR) funds. Local governments can consider the alternatives:

- Local Government’s Budget Restructure – Local governments can optimise the utilisation of local budget by restructuring expenditure items and adjusting priorities that have been mandated by government regulations. Expenditures must be prioritised to handle healthcare, social safety nets, and the mitigation of local economic impacts.

- Religious Institution Voluntary Involvement – As a country predominantly inhabited by Moslems, Indonesia’s largest revenue comes from zakat (a form of religious obligatory almsgiving for Moslems). In light of the ongoing pandemic and economic crisis, the Indonesian Ulema Council (MUI) has mandated the utilisation of zakat for COVID-19 management through Fatwa No. 23 of 2020 MUI. Policy implementation with frameworks similar to the one that has been conducted by the Indonesian Moslem community could potentially be implemented to other religious communities (e.g., from punia funds of Hindus community, socio-economic development funds of Catholics community, etc.)

- Spatial Utilisation Disincentive – Disincentives are implemented to prevent, limit, or reduce spatial use activities inconsistent with spatial plans. This scheme’s potential revenue will ensure local governments’ funds because the authority for this arrangement lies at the local government level.

- Local Government Loan – Local government loan schemes have been implemented in several regions across Indonesia. The central government would provide loans to local governments to aid recovery to the national economy.

Policy Recommendations

In view of those problems and constraints, several policy recommendations can be outlined, both within the framework or considerations such as:

- General Recommendation

- Short-Term – The decentralisation of COVID-19 management: The standard regulation for non-natural national disaster occasion in Indonesia places the central government in command. Reflecting from the COVID-19, it is important to widen the scope of local governments’ discretions in case of increasing local outbreaks.

- Medium-Term – Integration of surveillance protocols: To create a conducive situation for local governments, various supervisory institutions that operate as separate entities must formulate supervisory protocols with specific standards.

- Long-Term: A proper pandemic response as a prerequisite to economic recovery: Given the pandemic’s escalation and the still unreliable supply of vaccine, public health should be prioritised to maintain a sense of safety to the public.

- Recommendation for Local Government

- Short-Term – Data synchronisation and update: There must be correspondence for various items, including regulations and databases, from the central government to local governments.

- Medium-Term – Fiscal optimisation for Local Government Revenue: Local governments must bolster their tax administration system via digitalisation of tax/levy services and bring service points closer to residential/office hubs.

- Long-Term – Financial inclusion: To provide social safety net funds and investment incentives, the process of financial inclusion must be carried out and be guaranteed that it will function well down to rural areas.

- Recommendation for Central Government

- Short-Term – Sanctions for delayed distribution of the General Allocation Fund: To ensure that the local governments are committed to the pandemic mitigation, a mechanism where local governments could be sanctioned by the central government for their failure in handling the pandemic must be implemented.

- Medium-Term – Changes to the sanction paradigm during the pandemic: Sanctions need to be applied selectively according to specified reasons. Technical problems would require assistance, but a fiscal sanction can be imposed if it is politically motivated and lacks commitment from the local government.

- Long-Term – Framework for assistance and control from the central government: Assistance and control are carried out to regions based on the agglomeration of the problems’ characteristics in each region.