This article is a summary of a chapter that this author contributed in the recently-published “The Digital Transformation of Logistics: Demystifying Impacts of the Fourth Industrial Revolution” (Kern & Sullivan (ed.), Wiley 2021). This chapter looks at China’s Digital Silk Road and its role in the roll-out of the Belt & Road Initiative, and how it is creating dual digital ecosystems beyond the current focus on smart-ports and shipping.

Whilst there are many advantages of a digital trading platform, such as integrated seamless financial transactions, there are also warning signs that this approach when trading with China is presenting significant issues that businesses need to be aware of and plan how to deal with. A starting point is to understand the context of China’s Digital Silk Road (DSR) within the Belt & Road Initiative (BRI) framework.

So, what is the Digital Silk Road?

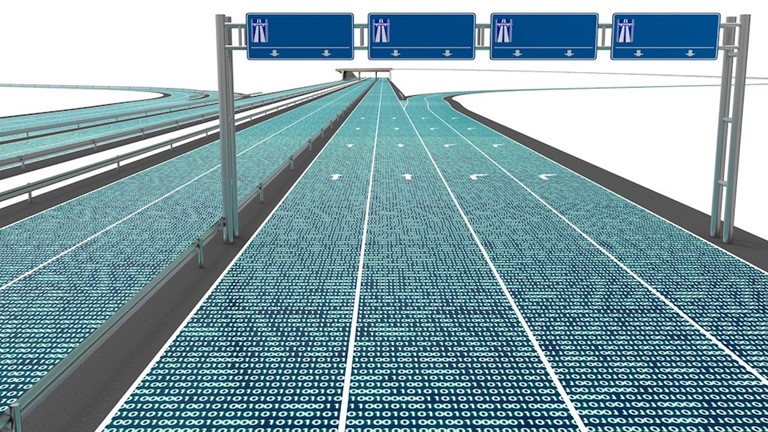

Whilst the DSR is attractive in that it offers a high degree of localization of products and services through partnering, its aim is to achieve digital integration by means of a single platform for all digital communication along the BRI. This strategic imperative was orchestrated under the 2012 China 17+1 Initiative, with the Greek port of Piraeus being seen as the “Dragons Head”. The digital platform facilitates integration of all service providers that want to conduct trade along the BRI and with China. In simple terms, it takes the discussion away from the idea of smart ports and/or cities to a digital regional trade ecosystem, with the ultimate goal of creating a Global Trade Ecosystem.

These ambitions of the DSR within China’s 17+1 framework have been largely undone through the Covid-19 pandemic and China’s increasing vindictive economic response to those countries that question China’s intent and commitment to being a responsible global player. Many of the 17+1 countries have pivoted away from their agreements with China and have joined the US 2020 Clean Network, a treaty for international digital standards aiming for the containment of Huawei’s influence in digital trade networks. This has been an important development in the context of Huawei having 91 committed 5G contracts in the EU as well as a plan to set up an EU manufacturing hub. It is reasonable for the EU to question whether the European-based manufacture hub appeases security concerns despite Huawei equipment manufactured under EU standard laws.

Trade consequences and issues when engaging the DSR, BRI and China

These developments have consequences for logistics and supply chain providers to global trading partners. They will disrupt the current digital developments being undertaken by the maritime sector, particularly the current trend that creates data silos within a port ecosystem. Further impacts will be felt by tech companies as business with DSR-aligned countries becomes more difficult due to cyber security concerns associated with China’s digital platform. This is particularly important when one considers that the merge points of Silk Road Economic Belt and the 21st Century Maritime Silk Road are largely ports, both maritime and inland dry ports. A good example of this is the Smart Port of Colombo in Sri Lanka that is having difficulty attracting investors other than China as the digital platform for the port has been developed and implemented by China’s state-owned enterprises (SOEs).

The core component of the strategy for the merge points is not just the development of the physical infrastructure, but includes a digital framework. The IT infrastructure allows China to digitally connect with countries with whom they trade but includes the requirement that this should result in seamless and integrated trade through improved information and communications. The centrality of cyber space and digitalization was highlighted by Xi Jinping’s announcement at the first BRI summit in 2017, where he stated that big data would be integrated into the BRI through the development of a “21st century Digital Silk Road” (DSR).

The DSR not only brings advanced IT infrastructure to BRI countries, such as broadband, e-commerce hubs and smart cities, but also introduces how digital integration requires a communication interface between maritime and land-based digital platforms along the BRI. In essence, it wants to dictate global technology standards and has set targets for the emerging technologies of artificial intelligence, blockchain and digital currencies.

Strategically, China’s external geo-political arrangements re-align partners’ interests with its own growth objectives, but in a manner that forces participants to comply with China’s IT standards. In a sense, it is fusing an alternative supply chain digital platform. This is confirmed by the fact that, while the number of funding / venture capital deals declined by 8% in 2020, the value of these deals has increased by 14%, reaching a value of US$132bn. It is also noteworthy that US$46bn was directed at the digital world, with 4 of the top 10 investments going to semi-conductor development.

Supply and development of semi- conductors is the soft underbelly of China’s cyber ambitions. What it does show is that the DSR is increasingly playing a central role in the development of a comprehensive package that includes policy dialogue, financial support, unimpeded trade, and people-to-people exchange. This China approach is to have all end-user devices / services interface along a central / common digital infrastructure corridor that includes cloud-based platforms.

The recent CCP Plenary sessions in Beijing had a special session focussing on creating new strengths in the digital economy. In part, this aimed at addressing a barrier to going forward, namely a lack of a central coordination mechanism, but also to address rising geo-political tensions as to the commercial intent of cross-border projects and trade by asserting greater control over all things digital.

How does this impact trade?

Increased trade and container traffic between Europe and Asia over the last few years has led to increased planning requirements for supply chain and logistics. With it came the need for processes to manage the freight movement using multi-modal transport options. Digitalization is seen as an answer towards meeting the challenges associated with growing requirements for transparency and visibility of cargo movement along these intermodal transport networks.

However, the DSR puts industry under pressure to design, develop, and implement a sustainable digital system that not just increases port / shipping operational efficiency, but one that is integrated into country-to-country trade. Whilst logistics and supply chain management have shifted towards the digital “fourth revolution” by enabling greater cargo visibility and transparency, it comes up short when considering last- and first-mile logistics through multi-modal transport systems.

This is increasingly evident when you consider that China has moved trade and maritime digital systems from dealing with trans-shipment ports to a focus on gateway ports. The merge points of the BRI are essentially gateway ports connecting with multi-modal transport options that take smart-port development beyond the traditional port-to-port delivery optimization.

Furthermore the scale of e-commerce within China has seen a change from Full Container Load (FCL) to Less-than-Container Load (LCL) freight movement, requiring a greater level of cargo visibility / traceability / monitoring than before. In the main, smart maritime digitization and digitalization do not fully provide the solution to current information and data gaps between participants along the supply and logistics chain.

The geo-political tensions between China and much of Europe have crystalized the debate around how digital integration is to take place within the BRI trading ecosystem with China. Important strategic questions that need answering include whether global trade operates on a single digital platform or a multitude of platforms. If there are a multitude of platforms, such as Application Programming Interface (API) and Electronic Data Interchange (EDI) standards, what do we put in place that would allow differing operating data systems to communicate with each other? How is the vision of a cyber network that connects data points and allows seamless inter-operability within a network’s ecosystem?

Answers to these questions are difficult as it requires a greater level of trust in dealing with large-scale data processing and fusion, data storage and operability across sovereign borders. These issues will eventually merge into what is a quickly developing dual digital trade ecosystem, these being a China-centric system versus a Western-aligned system. Further evidence of this dual development in smart / digital trade is the recent announcement by the Digital Container Shipping Association of the introduction of an open-source Track and Trace system. By using the same API code, this system will enable data transmission between the different software platforms that have been developed by the nine participating shipping companies. Whilst it will advance visibility and real-time responsiveness, it does not include shipping lines from China.

As mentioned previously, China’s API is based on the use of a single platform that takes account of whole cargo delivery cycles that include first- / last-mile considerations and not just port-to-port. It wants a platform that allows the seamless and transparent flow of data and information to facilitate trade with China and along the BRI.

Towards a dual digital trade ecosystem?

Trade and supply chain transparency within each of the dual digital eco-system is relatively easy to resolve as there is enough trust within each ecosystem to allow for suitable API and EDI facilitated data exchange. However, the greatest hurdle to truly integrated global trade between the two ecosystems centers around questions of cyber security, intellectual property (IP) protection, software ownership and trust. Until these are answered, it is unlikely that there will be a viable communication interface between the two systems that would allow for a seamless and transparent exchange of data and information.

Until countries and trade participants vigorously interrogate systems such as API and EDI standards and have a common approach to systems, the biggest issue confronting current digital development is how to address this communication gap. Unless this is resolved, we are on a path to two separate trade digital ecosystems with the associated problem of how best to exchange data between China’s DSR and the Western-aligned digital trade platform.

Global trading partners may have seen a single digital smart world trading platform as the way forward to transparent and seamless trade, however the true nature emerging is that of a dual trading ecosystem. Those that want to trade within and between both worlds will need to consider how best to manage this within an increasingly digitalized world, be this through a manual system of data transfer between systems or perhaps the creation of digital twins to optimize this exchange.

This article retrieved from: https://asiapowerwatch.com/what-does-digital-integration-mean-for-trade-logistics-and-supply-chains-with-china/ ,19 May 2021, 1:50PM Jakarta Time.